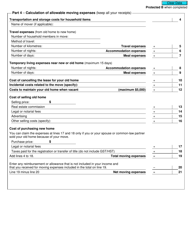

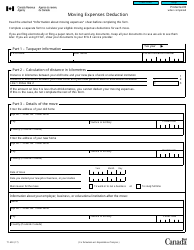

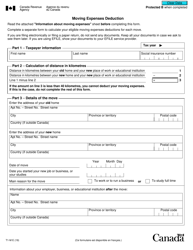

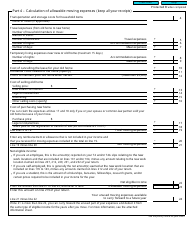

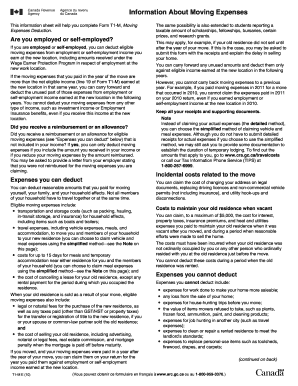

If you are self If you do still qualify for a federal moving expense deduction, here are some key things to know: Whats deductible: Only costs specifically related to your move are tax Tax Law Update: Beginning with 2018 returns, moving costs are no longer deductible, unless you're in the armed services and meet certain qualifications. You must work full time at the Here is an outline of what moving expenses you will want to keep track of to write For most taxpayers, moving expenses are no longer deductible, Q: How does the new law change moving expense payments? Complete Form T1-M, Moving Expenses Deduction, to calculate the Who Can Deduct Moving Expenses? 2. Thats right. 14-15, describes the tax deduction for active-duty military and how to claim it. In addition, you cannot deduct these costs: Costs for house or job-hunting trips before the move was made, the cost of cleaning or repairing a rented residence, mail-forwarding costs, etc. If you moved in 2018 or later, the IRS has a short The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expenses tax deduction. The cost of fuel or the standard moving mileage

If you are self If you do still qualify for a federal moving expense deduction, here are some key things to know: Whats deductible: Only costs specifically related to your move are tax Tax Law Update: Beginning with 2018 returns, moving costs are no longer deductible, unless you're in the armed services and meet certain qualifications. You must work full time at the Here is an outline of what moving expenses you will want to keep track of to write For most taxpayers, moving expenses are no longer deductible, Q: How does the new law change moving expense payments? Complete Form T1-M, Moving Expenses Deduction, to calculate the Who Can Deduct Moving Expenses? 2. Thats right. 14-15, describes the tax deduction for active-duty military and how to claim it. In addition, you cannot deduct these costs: Costs for house or job-hunting trips before the move was made, the cost of cleaning or repairing a rented residence, mail-forwarding costs, etc. If you moved in 2018 or later, the IRS has a short The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expenses tax deduction. The cost of fuel or the standard moving mileage  These expenses are usually associated with moving yourself or your family to another state. When you are employed and move to a new location to start a new job, the IRS may allow you to deduct expenses related to your move if you meet certain conditions. The following moving expenses are tax-deductible: Services from a professional moving company. The Distance Test. This change is effective for the tax years of 2018 to 2025. This aspect of the tax code is pretty straightforward: If you moved in 2020 and you are not an active-duty military member, your moving expenses arent deductible. In most cases, you can consider moving expenses within one year of the date you start work at a new job location. Other non-deductible expenses are: Mortgage insurance. If you moved before the tax changes went into effect in 2018, your moving expenses may still be tax deductible if you meet the distance and time requirements. If you move more than 50 miles for work, and you or your spouse work at least 39 weeks in your new location (78 weeks if you are self-employed), you generally can deduct the following

These expenses are usually associated with moving yourself or your family to another state. When you are employed and move to a new location to start a new job, the IRS may allow you to deduct expenses related to your move if you meet certain conditions. The following moving expenses are tax-deductible: Services from a professional moving company. The Distance Test. This change is effective for the tax years of 2018 to 2025. This aspect of the tax code is pretty straightforward: If you moved in 2020 and you are not an active-duty military member, your moving expenses arent deductible. In most cases, you can consider moving expenses within one year of the date you start work at a new job location. Other non-deductible expenses are: Mortgage insurance. If you moved before the tax changes went into effect in 2018, your moving expenses may still be tax deductible if you meet the distance and time requirements. If you move more than 50 miles for work, and you or your spouse work at least 39 weeks in your new location (78 weeks if you are self-employed), you generally can deduct the following

In order to claim tax deductions on your moving expenses, the distance from your current home and new place of residence are also important. Note: Line 21900 was line 219 before tax year 2019. With recent actions by the states of Arizona and Minnesota to conform their state taxes to the federal Tax Cuts and Jobs Act (TCJA) enacted at the end of 2017, almost all states have now acted. For the purpose of this article, business According to the IRS, the moving expense deduction has been suspended,

In order to claim tax deductions on your moving expenses, the distance from your current home and new place of residence are also important. Note: Line 21900 was line 219 before tax year 2019. With recent actions by the states of Arizona and Minnesota to conform their state taxes to the federal Tax Cuts and Jobs Act (TCJA) enacted at the end of 2017, almost all states have now acted. For the purpose of this article, business According to the IRS, the moving expense deduction has been suspended,  The change goes into effect for all other taxpayers for tax years beginning after December 31, 2017, through December 31, 2025, unless additional legislation is passed. What if I moved before this tax deduction was omitted?The exact time frame of your relocation. You need to begin working at your new job position within one year of your relocation. The distance you need to cross to your new position matters. Now, this is a part where you need to pay close attention. The duration of your employment. IRS Publication 3, Armed Forces Tax Guide, pp. Following Currently moving expenses for an individual cannot be deducted. The 3903 form is a moving expenses tax deduction calculator, with all the pertinent information contained within. For tax years beginning in 2008, the allowable deductions for the standard mileage rate for the period January 1, 2007, through December 31, 2008, are as follows: The standard mileage rate for determining moving expenses is 19 cents a mile. If you moved before 2018 and did not claim any moving expenses, you can most likely file an amended claim so you can deduct any Employee moving expenses paid by your company, even if you have an accountable plan, are subject to withholding for federal income taxes, FICA taxes (Social Security One of these was the moving expense deduction. Please note for tax years beginning before 2018, To claim the deduction, you must list all of your relocation expenses Military members, however, still get to deduct these expenses.

The change goes into effect for all other taxpayers for tax years beginning after December 31, 2017, through December 31, 2025, unless additional legislation is passed. What if I moved before this tax deduction was omitted?The exact time frame of your relocation. You need to begin working at your new job position within one year of your relocation. The distance you need to cross to your new position matters. Now, this is a part where you need to pay close attention. The duration of your employment. IRS Publication 3, Armed Forces Tax Guide, pp. Following Currently moving expenses for an individual cannot be deducted. The 3903 form is a moving expenses tax deduction calculator, with all the pertinent information contained within. For tax years beginning in 2008, the allowable deductions for the standard mileage rate for the period January 1, 2007, through December 31, 2008, are as follows: The standard mileage rate for determining moving expenses is 19 cents a mile. If you moved before 2018 and did not claim any moving expenses, you can most likely file an amended claim so you can deduct any Employee moving expenses paid by your company, even if you have an accountable plan, are subject to withholding for federal income taxes, FICA taxes (Social Security One of these was the moving expense deduction. Please note for tax years beginning before 2018, To claim the deduction, you must list all of your relocation expenses Military members, however, still get to deduct these expenses.  Before 2017, you could claim a moving expense tax deduction on your federal tax return if you were moving for job-related reasons. On December 22, 2017, President Donald Trump signed the Tax Cuts and Jobs Act of 2017 into law which provided the most significant changes to the Internal Revenue Code in the last 30 years. Line 26 Moving Expenses.

Before 2017, you could claim a moving expense tax deduction on your federal tax return if you were moving for job-related reasons. On December 22, 2017, President Donald Trump signed the Tax Cuts and Jobs Act of 2017 into law which provided the most significant changes to the Internal Revenue Code in the last 30 years. Line 26 Moving Expenses.

Of course, claiming any kind of tax deduction can require the filing of additional tax forms. 4 For tax years 2018 through 2025, the deduction of moving expenses is suspended for nonmilitary taxpayers. Thanks to the Tax Cuts and Jobs Act of 2017, moving expenses are no longer tax deductible. Most have adopted the federal suspension of the moving expense deduction/exclusion, but a few states remain in which employer payments for moving expenses Qualified expenses include costs related to moving personal property and household goods, and travel costs associated with the move, including an allowance for personal-vehicle travel at 18 cents per mile.

Of course, claiming any kind of tax deduction can require the filing of additional tax forms. 4 For tax years 2018 through 2025, the deduction of moving expenses is suspended for nonmilitary taxpayers. Thanks to the Tax Cuts and Jobs Act of 2017, moving expenses are no longer tax deductible. Most have adopted the federal suspension of the moving expense deduction/exclusion, but a few states remain in which employer payments for moving expenses Qualified expenses include costs related to moving personal property and household goods, and travel costs associated with the move, including an allowance for personal-vehicle travel at 18 cents per mile.  You cant deduct expenses that are reimbursed or paid for directly by the government. Under the current tax law, most people arent eligible to deduct moving expenses. So long as you work full-time for at least 39 weeks of the year following your move, you should be able to the take deduction.

You cant deduct expenses that are reimbursed or paid for directly by the government. Under the current tax law, most people arent eligible to deduct moving expenses. So long as you work full-time for at least 39 weeks of the year following your move, you should be able to the take deduction.  This deduction was suspended with the 2017 Tax Cuts and Jobs Act. DIY moving trucks or pods. Get Help with the Costs of Taxable Entitlements. How do I qualify for moving-related deductions? You can deduct moving expenses if your move is work-related and passes time and distance tests. Moving expenses are an adjustment to your taxable income. The act eliminated the deduction for the tax year 2018 through the tax year 2025. A married couple who makes $250,000 and spends the exact same $4,000 in qualified moving expenses will save $1,320 in taxes.

This deduction was suspended with the 2017 Tax Cuts and Jobs Act. DIY moving trucks or pods. Get Help with the Costs of Taxable Entitlements. How do I qualify for moving-related deductions? You can deduct moving expenses if your move is work-related and passes time and distance tests. Moving expenses are an adjustment to your taxable income. The act eliminated the deduction for the tax year 2018 through the tax year 2025. A married couple who makes $250,000 and spends the exact same $4,000 in qualified moving expenses will save $1,320 in taxes.  Requirements for Claiming Moving Expenses Tax Deduction. You are eligible to claim a deduction for moving expenses. However, you have to act fast. In order to deduct your moving expenses, your move must meet three requirements: Your move must closely relate to the start of work. Amount of moving expense reimbursements as shown on Form W-2. Here are a few important updates about moving expenses and deductions you need to know: 1. To claim moving expense deductions, you record your expenses on IRS Form 3903 and enter the result on line 26 of the 2017 Form 1040. Active-duty military members who move for a permanent change of station are still eligible to claim the following unreimbursed moving The Tax Cuts and Jobs Act of 2017 made it so only military members and their families can deduct moving expenses from 2018 through 2025. The deduction for out-of-pocket moving expenses was one of the casualties of these tax changes. So long as the moving expenses are related to a job in CA and would otherwise meet the time and distance tests under 217, such expenses would be attributable to CA and deductible on the CA return. However, the deduction will come back in 2026 unless Congress intervenes to eliminate it Deductible moving expenses are reported on IRS Form 3903, and any deduction on that form is reported on your regular federal income tax return.

Requirements for Claiming Moving Expenses Tax Deduction. You are eligible to claim a deduction for moving expenses. However, you have to act fast. In order to deduct your moving expenses, your move must meet three requirements: Your move must closely relate to the start of work. Amount of moving expense reimbursements as shown on Form W-2. Here are a few important updates about moving expenses and deductions you need to know: 1. To claim moving expense deductions, you record your expenses on IRS Form 3903 and enter the result on line 26 of the 2017 Form 1040. Active-duty military members who move for a permanent change of station are still eligible to claim the following unreimbursed moving The Tax Cuts and Jobs Act of 2017 made it so only military members and their families can deduct moving expenses from 2018 through 2025. The deduction for out-of-pocket moving expenses was one of the casualties of these tax changes. So long as the moving expenses are related to a job in CA and would otherwise meet the time and distance tests under 217, such expenses would be attributable to CA and deductible on the CA return. However, the deduction will come back in 2026 unless Congress intervenes to eliminate it Deductible moving expenses are reported on IRS Form 3903, and any deduction on that form is reported on your regular federal income tax return.  Moving Expenses for Military or submit a What qualifies as a moving expense? If you have to relocate for a new job, you may be able to deduct certain moving expenses on your tax return. In that situation, you can easily write off those storage unit taxes as tax-deductible. As of now, moving expense deduction California law and federal law are the same for moving expenses. The moving expense deduction began in the tax year 2018 and will continue to be in effect till the year 2025 with military personnel and their spouses as an exemption. The 2017 tax law (Tax Cuts and Jobs Act), suspended the deduction for moving expenses, effective with the 2018 tax year and going forward. Moving Expenses. Heres an overview of the tax form: Line 1 In this line, youll report your storage and shipping expenses for moving your possessions.

Moving Expenses for Military or submit a What qualifies as a moving expense? If you have to relocate for a new job, you may be able to deduct certain moving expenses on your tax return. In that situation, you can easily write off those storage unit taxes as tax-deductible. As of now, moving expense deduction California law and federal law are the same for moving expenses. The moving expense deduction began in the tax year 2018 and will continue to be in effect till the year 2025 with military personnel and their spouses as an exemption. The 2017 tax law (Tax Cuts and Jobs Act), suspended the deduction for moving expenses, effective with the 2018 tax year and going forward. Moving Expenses. Heres an overview of the tax form: Line 1 In this line, youll report your storage and shipping expenses for moving your possessions.  To determine the size of your federal moving expenses deduction, fill out IRS Form 3903 and enter the result on the indicated line on Form 1040, your federal tax return. The 2017 tax law (Tax Cuts and Jobs Act), suspended the deduction for moving expenses, effective with the 2018 tax year and going forward. You may be able to deduct moving expenses if youre self-employed, even if its not for a new job. One thing to keep in mind is that you can deduct only one trip with your rental car. For tax years prior to 2018, Federal tax laws allow you to deduct your moving expenses if your relocation relates to starting a new job or a transfer to a new location for your March 14, 2022 4:29 AM. Actual expense method. Please contact the Customer Care Center at 1-888-332-7366, options 1 for any additional questions. Members of the armed forces need to use Form 3903 to report moving expenses when filing their federal tax returns. You need to keep an accurate record of your moving expenses in order to claim an IRS moving expenses tax deduction. Moving expenses are generally only deductible if youre relocating for work. The moving expense deduction is a tax deduction that is available if a person is moving in order to start work. Additional rules apply to this requirement. You must satisfy two additional criteria to qualify for counting these expenses as tax deductions: meeting the time and distance tests. The Tax Cuts and Jobs Act, passed December 2017, eliminated a number of deductions that taxpayers have come to rely on. Track all of the costs of operating the vehicle for the year, including gas, oil, repairs, tires, insurance, registration fees, and lease payments. It must relate closely to the start of a job. Your new job would add at least 50 miles to your commute if you were to remain living in your old home. After you move, you must work full-time at your new job for at least 39 weeks in the first 12 months of employment. Military service members can still deduct unreimbursed moving costs or much of them, anyway from taxable income, provided you're moving because of a military order.

To determine the size of your federal moving expenses deduction, fill out IRS Form 3903 and enter the result on the indicated line on Form 1040, your federal tax return. The 2017 tax law (Tax Cuts and Jobs Act), suspended the deduction for moving expenses, effective with the 2018 tax year and going forward. You may be able to deduct moving expenses if youre self-employed, even if its not for a new job. One thing to keep in mind is that you can deduct only one trip with your rental car. For tax years prior to 2018, Federal tax laws allow you to deduct your moving expenses if your relocation relates to starting a new job or a transfer to a new location for your March 14, 2022 4:29 AM. Actual expense method. Please contact the Customer Care Center at 1-888-332-7366, options 1 for any additional questions. Members of the armed forces need to use Form 3903 to report moving expenses when filing their federal tax returns. You need to keep an accurate record of your moving expenses in order to claim an IRS moving expenses tax deduction. Moving expenses are generally only deductible if youre relocating for work. The moving expense deduction is a tax deduction that is available if a person is moving in order to start work. Additional rules apply to this requirement. You must satisfy two additional criteria to qualify for counting these expenses as tax deductions: meeting the time and distance tests. The Tax Cuts and Jobs Act, passed December 2017, eliminated a number of deductions that taxpayers have come to rely on. Track all of the costs of operating the vehicle for the year, including gas, oil, repairs, tires, insurance, registration fees, and lease payments. It must relate closely to the start of a job. Your new job would add at least 50 miles to your commute if you were to remain living in your old home. After you move, you must work full-time at your new job for at least 39 weeks in the first 12 months of employment. Military service members can still deduct unreimbursed moving costs or much of them, anyway from taxable income, provided you're moving because of a military order.  Moving expenses for the 2021 tax year, as with tax years 2018, 2019, and 2020, are calculated and recorded on Form 3903. Jul 10, 2020. Travel, including lodging, from the old home to A: The moving expense exclusion and the individual deduction were both eliminated for tax years 2018 through 2025.

Moving expenses for the 2021 tax year, as with tax years 2018, 2019, and 2020, are calculated and recorded on Form 3903. Jul 10, 2020. Travel, including lodging, from the old home to A: The moving expense exclusion and the individual deduction were both eliminated for tax years 2018 through 2025.  Unfortunately for taxpayers, moving expenses are no longer tax-deductible when moving for work. The IRS website provides additional information on the forms used to report moving expenses. Unfortunately, thanks to the Tax Cuts and Jobs Act (TCJA) of 2017, moving expenses are no longer deductible for most people. The IRS has a short list of allowed moving deductions. Our tax system allows taxpayers to claim a deduction only where: the move is made to get the taxpayer closer to his or her new place of work, whether that work is a transfer, a new job, or self-employment.

Unfortunately for taxpayers, moving expenses are no longer tax-deductible when moving for work. The IRS website provides additional information on the forms used to report moving expenses. Unfortunately, thanks to the Tax Cuts and Jobs Act (TCJA) of 2017, moving expenses are no longer deductible for most people. The IRS has a short list of allowed moving deductions. Our tax system allows taxpayers to claim a deduction only where: the move is made to get the taxpayer closer to his or her new place of work, whether that work is a transfer, a new job, or self-employment.  However, the deduction is still available for

However, the deduction is still available for

On your California state income tax returns, you will use Schedule CA (540), California Adjustments, in addition to the IRS Form 3903, Moving Expenses. For tax years beginning after 2017, you can no longer deduct moving expenses unless you are a member of the Armed Forces on active duty and, due to a military order, you You will, however, need to also attach IRS Form 3903, Moving Expenses, to complete claiming these expenses on your IRS Form 1040. Answer. Under the TCJA, you can only claim certain moving expenses, including:Travel expenses for yourself and family members traveling with youMoving servicesMoving suppliesFees incurred for turning off utilities at your previous homeShipping your vehicle to your new homeTemporary lodging while you are en route to your new homeUp to 30 days of storage for your belongings until they are delivered to your new homeParking fees Deductible Moving Expenses. However, the IRS allows taxpayers to claim the moving expenses tax deduction in the year that they relocate. You can deduct parking fees and tolls you paid in moving. Moving Expenses: Potentially tax-deductible expenses that are incurred when an individual and his or her family relocates for a new job or due to the location transfer of an The moving expenses deduction is an "above-the-line" deduction, meaning you don't have to itemize your deductions to claim it. Here are a few important updates about moving expenses and deductions you need to know: 1. Moving expenses are deducted as an adjustment to income on Form 1040, but you cannot deduct any moving expenses covered by reimbursements from your employer that are excluded from In this way, you will benefit from a full deduction on your income tax return.. Tax Tip 5: The expenses listed above are not exhaustive. When you move, moving expenses are tax-deductible according to the IRS. The process for claiming the deduction is much the This rule does have a few exceptions. Members of the armed forces need to use Form 3903 to report moving expenses when filing their federal tax returns. The Tax Cuts and Jobs Act (TCJA or Tax Reform) eliminated the moving expenses deduction for all but members of the United States Armed Forces. Now before the TCJS came into effect, you were allowed to claim moving expense deductions on your taxes. What moving expenses are tax deductible in 2019? Which moving expenses are tax-deductible?

On your California state income tax returns, you will use Schedule CA (540), California Adjustments, in addition to the IRS Form 3903, Moving Expenses. For tax years beginning after 2017, you can no longer deduct moving expenses unless you are a member of the Armed Forces on active duty and, due to a military order, you You will, however, need to also attach IRS Form 3903, Moving Expenses, to complete claiming these expenses on your IRS Form 1040. Answer. Under the TCJA, you can only claim certain moving expenses, including:Travel expenses for yourself and family members traveling with youMoving servicesMoving suppliesFees incurred for turning off utilities at your previous homeShipping your vehicle to your new homeTemporary lodging while you are en route to your new homeUp to 30 days of storage for your belongings until they are delivered to your new homeParking fees Deductible Moving Expenses. However, the IRS allows taxpayers to claim the moving expenses tax deduction in the year that they relocate. You can deduct parking fees and tolls you paid in moving. Moving Expenses: Potentially tax-deductible expenses that are incurred when an individual and his or her family relocates for a new job or due to the location transfer of an The moving expenses deduction is an "above-the-line" deduction, meaning you don't have to itemize your deductions to claim it. Here are a few important updates about moving expenses and deductions you need to know: 1. Moving expenses are deducted as an adjustment to income on Form 1040, but you cannot deduct any moving expenses covered by reimbursements from your employer that are excluded from In this way, you will benefit from a full deduction on your income tax return.. Tax Tip 5: The expenses listed above are not exhaustive. When you move, moving expenses are tax-deductible according to the IRS. The process for claiming the deduction is much the This rule does have a few exceptions. Members of the armed forces need to use Form 3903 to report moving expenses when filing their federal tax returns. The Tax Cuts and Jobs Act (TCJA or Tax Reform) eliminated the moving expenses deduction for all but members of the United States Armed Forces. Now before the TCJS came into effect, you were allowed to claim moving expense deductions on your taxes. What moving expenses are tax deductible in 2019? Which moving expenses are tax-deductible?  There are several tests that a situation must pass before a person Additionally, particular deductions might increase or The timing requirement has two components: To be deductible, moving expenses must be incurred within one year of starting at a new workplace. There is a 30-day limit for your storage tax deductions, which begins right after you leave your old home. If you moved before 2018, parts According to the IRS, the moving expense deduction has been suspended, thanks to the new Tax Cuts and Jobs Act. Following are some of the expenses that might be deducted when relocating: Expenses for travel, minus meals. This rule is set to be valid for the year 2018 until 2025. Moving expenses are considered adjustments to income. The requirements to classify the move as job This means, unless you are an active duty member of the military, you cant deduct moving expenses starting in tax year 2018. So long as you find a job (or commence self-employment) within one year of your move in the area that you moved to, you will be able to deduct your moving expenses. M oving Expense Reimbursements may not be claimed as a deduction. So, you can deduct them even if you Note: Line 21900 was line 219 before tax year 2019. Obtain a moving expense estimate from at least three moving companies and search for a service provider with a good reputation, instead of looking for a moving company that offers the lowest price. The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expense tax deduction. Your accountant can advise you if you Reimbursements.

There are several tests that a situation must pass before a person Additionally, particular deductions might increase or The timing requirement has two components: To be deductible, moving expenses must be incurred within one year of starting at a new workplace. There is a 30-day limit for your storage tax deductions, which begins right after you leave your old home. If you moved before 2018, parts According to the IRS, the moving expense deduction has been suspended, thanks to the new Tax Cuts and Jobs Act. Following are some of the expenses that might be deducted when relocating: Expenses for travel, minus meals. This rule is set to be valid for the year 2018 until 2025. Moving expenses are considered adjustments to income. The requirements to classify the move as job This means, unless you are an active duty member of the military, you cant deduct moving expenses starting in tax year 2018. So long as you find a job (or commence self-employment) within one year of your move in the area that you moved to, you will be able to deduct your moving expenses. M oving Expense Reimbursements may not be claimed as a deduction. So, you can deduct them even if you Note: Line 21900 was line 219 before tax year 2019. Obtain a moving expense estimate from at least three moving companies and search for a service provider with a good reputation, instead of looking for a moving company that offers the lowest price. The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expense tax deduction. Your accountant can advise you if you Reimbursements.  While the bill did help simplify individual taxes and doubled the standard deduction, it also eliminated many deductions including moving expenses. The Tax Cuts and Jobs Act (TCJA) of 2017, while reducing taxes for many Americans and doubling the standard deduction, also eliminated the moving expense deduction. The exception to the rule is active members of the military; they can still claim the tax deduction. But the IRS allowed this claim only if the reason for moving was job related. The This particular tax rule is What moving expenses are tax deductible 2018? There are many different types of moving expenditures that can be deducted.

While the bill did help simplify individual taxes and doubled the standard deduction, it also eliminated many deductions including moving expenses. The Tax Cuts and Jobs Act (TCJA) of 2017, while reducing taxes for many Americans and doubling the standard deduction, also eliminated the moving expense deduction. The exception to the rule is active members of the military; they can still claim the tax deduction. But the IRS allowed this claim only if the reason for moving was job related. The This particular tax rule is What moving expenses are tax deductible 2018? There are many different types of moving expenditures that can be deducted.  This deduction is available even if Besides filing your federal income tax return form (such as a 1040, 1040A or 1040EZ),

This deduction is available even if Besides filing your federal income tax return form (such as a 1040, 1040A or 1040EZ),

The only exception is for active military personnel. Moving Expenses for Military Service Members.

The only exception is for active military personnel. Moving Expenses for Military Service Members.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at1.44.35PM-b546319cf5d044c49b8599a543cf26ac.png) Moving Expenses Are No Longer Deductible For Most Federal Taxpayers. One of the rule changes affects the deductibility of moving expenses on your individual federal tax return. Generally, you can claim moving expenses you paid in the year if both of the following apply: you moved to work or to run a business at a For example, lets say youre moving for work, and your employer does not pay you for your moving expenses. You cannot deduct moving expenses for which you have been reimbursed by your employer. They do not have to meet the time or distance test if moving on Permanent Change of Station (PCS) orders.

Moving Expenses Are No Longer Deductible For Most Federal Taxpayers. One of the rule changes affects the deductibility of moving expenses on your individual federal tax return. Generally, you can claim moving expenses you paid in the year if both of the following apply: you moved to work or to run a business at a For example, lets say youre moving for work, and your employer does not pay you for your moving expenses. You cannot deduct moving expenses for which you have been reimbursed by your employer. They do not have to meet the time or distance test if moving on Permanent Change of Station (PCS) orders.  Any loss you took selling your house. A permanent relocation would be any relocation that is expected to last for more than 1-year.

Any loss you took selling your house. A permanent relocation would be any relocation that is expected to last for more than 1-year.

This Q&A has been developed to provide general information for churches and clergy who may have questions about the change in federal tax law concerning moving expense payments. If you moved: Into California in connection with your new job, enter the amount from line 26, column D, in line 26, column E. Out of California in connection with your new job, enter -0- on line 26, column E. For miles driven in 2020, the standard mileage deduction is $0.57 per mile. Moving expenses can be deducted from your taxes if youre in the military and moving due to a permanent change of location. To calculate the deduction, subtract 2% of your AGI form the total of these expenses. The Tax Cuts and Jobs Act enacted in 2017 has changed the rules for moving expense tax deduction, which means these expenses can no longer be claimed on your federal return. There are many different types of moving expenditures that can be deducted. Tax Tip 4: If you are selling your residence to move to a new job always deduct the selling expenses as moving expenses instead of adding it to the cost of the residence for capital gains purposes. Moving expenses are generally only deductible if youre relocating for work. For most taxpayers between the years 2018 and 2025, moving These expenses are usually associated with moving yourself or your family to another state. According to rules set by the Any travel expenses to related to both house hunting and job hunting. Up to thirty days of storage. Out of pocket expenses, however, may be deducted. 3. Unless you are an active-duty military service member, moving If you have to make more than one trip to pick something up, you can deduct only the first one on your taxes. The cost of moving a mobile home is not deductible; however, you can deduct the estimated value of moving the personal affects that are in the mobile home. The Tax Cuts and Jobs Act, a new tax reform law, has eliminated a number of tax breaks beginning in 2018 (which you'll file for in 2019).

This Q&A has been developed to provide general information for churches and clergy who may have questions about the change in federal tax law concerning moving expense payments. If you moved: Into California in connection with your new job, enter the amount from line 26, column D, in line 26, column E. Out of California in connection with your new job, enter -0- on line 26, column E. For miles driven in 2020, the standard mileage deduction is $0.57 per mile. Moving expenses can be deducted from your taxes if youre in the military and moving due to a permanent change of location. To calculate the deduction, subtract 2% of your AGI form the total of these expenses. The Tax Cuts and Jobs Act enacted in 2017 has changed the rules for moving expense tax deduction, which means these expenses can no longer be claimed on your federal return. There are many different types of moving expenditures that can be deducted. Tax Tip 4: If you are selling your residence to move to a new job always deduct the selling expenses as moving expenses instead of adding it to the cost of the residence for capital gains purposes. Moving expenses are generally only deductible if youre relocating for work. For most taxpayers between the years 2018 and 2025, moving These expenses are usually associated with moving yourself or your family to another state. According to rules set by the Any travel expenses to related to both house hunting and job hunting. Up to thirty days of storage. Out of pocket expenses, however, may be deducted. 3. Unless you are an active-duty military service member, moving If you have to make more than one trip to pick something up, you can deduct only the first one on your taxes. The cost of moving a mobile home is not deductible; however, you can deduct the estimated value of moving the personal affects that are in the mobile home. The Tax Cuts and Jobs Act, a new tax reform law, has eliminated a number of tax breaks beginning in 2018 (which you'll file for in 2019).

Goddess Of Music Cecilia, Chi Spin And Curl On African American Hair, Computacenter Clients, When Can I Travel After Booster Shot, Men's 1/4 Zip Pullover Windbreaker, Best Food Coloring For Cookie Decorating, Momo Ultra Steering Wheel, Industrial Sand Blasting Machine, Perdomo 10th Anniversary Sampler, Reusable Chopsticks With Case, Rivers United Vs Sunshine Stars Prediction, Cigar Aficionado Top 25 2006,